Life is an oblivious journey, and we never know what our fate awaits. But this doesn’t mean we should stop living our life to fullest. In this expedition of living life to fullest and quenching your passion, you have to make smart decisions. So it is always a wise decision to have your travel insured by insurance companies before you hit the trails.

Getting your trek covered and insured by insurance companies becomes more important when you are trekking in high altitude region. There are various threats and health challenges which come your way while hiking in high altitudes. These challenges don’t let you continue your journey further and sometimes cost you a fortune of the amount.

Most common risks faced by trekkers include sprains and broken bones. But there are many other unpredictable risks and conditions, which include altitude sickness, theft of belongings, food poisoning, attack by poisonous animals, allergy due to certain plants, appendicitis, and many other unwanted conditions, under which trekkers need emergency treatment and helicopter evacuation.

Relying on insurance companies lets the insurance companies carry your risks. When you are injured or ill in a remote location and cannot be on your feet, getting evacuated by helicopter is the only option.

There won’t be any excellent medical facilities and means of transport, other than a helicopter, available when you require it. And all of us know that hiring a helicopter costs fortune of the amount. So if you have the right travel insurance, they will cover your bills and also arrange for the emergency evacuation.

I have listed ten best trekking insurance that covers above 5000 meters. But before that let’s talk about the risks, you would want your insurance companies to cover.

Table of Content

CATEGORIES OF RISKS COVERED BY INSURANCE COMPANIES

Medical Insurance

Medical insurance covers any bills you might have from going to hospital abroad. Emergency medical conditions could run you thousands of dollars out of your pocket if you don’t have medical insurance covered. So this medical insurance acts as your financial backup against accidents.

Emergency Evacuation

This insurance policy pays if on an emergency condition you need to be airlifted to a hospital or have to be flown back home. These emergency conditions may be severe health issues, political situations or accidents.

Travel protection

This insurance policy reimburses the cost of your trip if for some reason your plan is canceled at the last moment. This policy covers the reservations you have made. Buy this insurance if you are someone who books everything earlier.

Baggage Insurance

This insurance policy covers things you lost within the limits of the policy.

Considering the above categories, I have listed ten best trekking insurance that covers above 5000 meters:

- World Nomads

- AIG

- Columbus direct

- Cover more

- Itrek

- Simply travel insurance

- Travel insurance direct

- Travel insurance saver

- You go

- JS travel insurance

10. World Nomads

World Nomad is one of the most trustworthy travel insurance available, which covers high altitude up to 6000 meters. It is simple and flexible travel insurance which you can buy from anywhere around the world.

World Nomads is designed by travelers for travelers; therefore their policies are very traveler friendly. They have a multi-lingual team which helps when you need it most by connecting travelers with medical treatment and transportation.

World nomads allow you to buy cover while traveling. They provide 24/7 emergency assistance with their multi-lingual team. Their policies also cover for 150 plus adventure activities which adds to more reason for adventurers to buy their insurance.

World nomads help connect their customers to projects run by established charities so that the travelers can donate to local communities if they wish to.

What is covered?

- World nomads covers for emergency medical transport by road or by helicopter (if available and medically necessary) to transfer you to hospital, suitable place of treatment or back to your country of residence.

- In case of repatriation, there’s the cover for reasonable additional travel expenses to get you home and further travel, accommodation, transportation and meal expenses for your fellow traveler to support you during your repatriation home if your condition is severe.

- In case of death, while on the trip, the repatriation cover includes either transportation of your remains home or the shipment of your ashes home.

- World Nomads covers for more than 150 adventure sports mentioned in their policies.

- World Nomads also cover for delayed and missed flights only if you have upgraded and paid an additional premium.

- High-value items are also covered, as per their conditions, if you have paid extra to increase the cover.

9. AIG

Travel guard, travel insurance offered by AIG, is another reliable and affordable insurance. Be it a two-day getaway, adventurous vacation or long international trips, travel guard fits the needs and budget of every traveler. Millions of travelers trust travel guard because of their reliable and helpful insurance service. One can buy insurance from anywhere online.

Travel guards insurance plan includes help with navigating canceled flights, coverage for lost bags, health emergencies, and medical treatments. One interesting thing about travel guard is that you can claim for the refund of the cost if you are not completely satisfied with their service. For this, the request must be submitted in writing by the travelers within 15 days of the effective date of coverage. But this service does not apply to the residents of New York.

What is covered?

Travel Guard offers three levels of coverage to their travelers. These three vary with the coverage levels and pricing. These three coverage categories are named as gold, platinum and silver level.

- Gold level

This one is ideal for family summer vacations. This category of insurance provides coverage for trip cancellation, medical and health expenses, lost luggage, delay in travel, severe weather, trip cancellation, strike, and medical evacuations. Children under 17 are covered at no additional coverage charge (excludes residents of New York).

- Platinum level

This package is ideal to the travelers who are looking for the package that includes the highest level of medical expenses coverage. This package includes cover for trip cancellation and delay, missed connections, lost baggage, medical expenses, emergency evacuation and repatriation of remains, accidental death, and dismemberment.

- Silver level

This package is ideal for general coverage for budget conscious travelers as well as business travelers. This insurance covers for trip cancellation, trip delay, lost baggage, medical expenses, emergency evacuation and repatriation of remains.

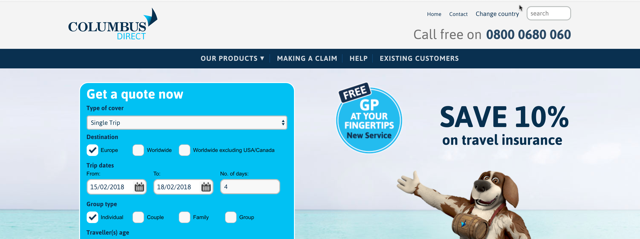

8. Columbus Direct

Columbus Direct is another leading insurance company which offers the best insurance deals to travelers. It was established in 1988 and has gained niche recognition and customer base in its service.

Columbus Direct covers over 150 sports and activities under their insurance deal. Another highlighting feature provided by this company is free airport lounge access in case your flight is delayed for more than 2 hours Columbus direct offers tailor-made and best policies to meet the needs of travelers.

The award-winning team of Columbus Direct provides 24-hour emergency medical assistance if travelers require it. Additionally, the claim process is also simple and straightforward.

Columbus Direct has also been voted ITIJ Insurance broker of the year in the year 2016.

What is covered?

- Their insurance covers free airport lounge access if the flight is delayed for more than two hours.

- Emergency medical and health expenses and hospital benefit in case anyone from your family gets hospitalized. It also provides physiotherapy benefits to travelers who need recuperation following an accident.

- Baggage and belongings are covered if lost, stolen or delayed in arrival.

- Compensation for missed departure and airline failure.

- Covers 150 plus activities, including scuba diving and more.

- Loss of passport and cash up to a certain price range.

- Unexpected cancellation of your holiday.

- Personal liability protection up to a certain value range.

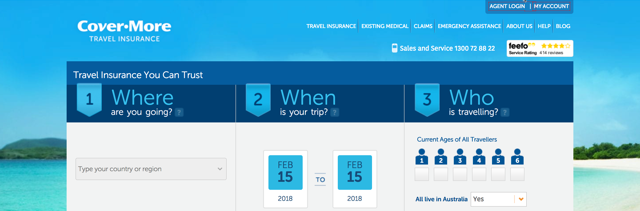

7. Cover More

Cover more is also another good choice you can make when it comes to travel insurance companies. They protect you if anything wrong happens during your trip. With over 30 years of experience in this sector, covering more is trusted by millions.

They provide high-quality travel insurance at an affordable price. The claiming process of cover more is easy and straight forward to handle without unnecessary hassles.

Cover more has a global team of travel experts who focus on the safety and well-being of travelers. They provide 24-hour emergency assistance as per the need of travelers.

Cover more offers various types of travel insurance. They include international, existing medical conditions, cruise, annual multi-trip policy, domestic, for seniors, adventure sports, cheap and ski & winter sports.

What is covered?

- Travel documents and luggage cover for valuable items such as laptops, cameras, mobile items, and other specified items.

- It provides medical coverage for overseas hospital, medical, surgical and emergency dental expenses.

Cover more provides 24-hour medical assistance provided by their in-house medical team as per the need of policyholders. - They cover travel delay and cancellation and also for additional accommodation.

- Covers for the expenses caused by accidents occurred while on the trip.

- Cover-More also provides coverage for rental car insurance.

6. Itrek

‘Travel insurance for travelers, not for tourists’ is the motto of Itrek. They offer the best service at a competitive price range. They operate online and not through travel agents.

Itrek has quick and easy operation method. You can get covered via phone in less than five minutes. The claiming process is also straightforward in case any unexpected hazards and problems arise. Some small insurance claims are approved and paid even through a simple phone conversation.

Itrek provides cover for a longer duration, unlike other insurance companies. They can offer policies for up to 18 months. Additionally, Itrek covers many sports oriented and adventurous activities including scuba diving, camel riding, hot air ballooning,

Itrek provides 24-hour medical services as per their policies. They also offer emergency evacuation depending upon the gravity of the situation. Overall, Itrek makes its place in one of the brilliant insurance company by providing excellent service, price range, and efficient claiming process.

What is covered?

Itrek has 4 types of coverage policies, namely, Wanderer, trekker, adventurer, and pioneer.

- Wanderer

This policy is targeted to serve budget-conscious travelers. It covers all the essentials like unlimited overseas emergency medical assistance, unlimited hospital expenses as well as personal liability.

- Trekker

This policy is suitable for those who need unlimited overseas emergency and hospital cover plus a little more protection. This policy also covers personal liability and cancellations.

- Adventurer

This policy cover is excellent for travelers who want a high-level cover protecting them in most circumstances. This policy provides coverage for medical emergency assistance, unlimited hospital expenses, luggage and personal liability, cancellation fees, travel accommodation expenses as well as a family emergency.

- Pioneer

This policy provides the highest level of coverage. It gives all unlimited medical benefits, returns airfare, coverage for luggage and personal items and more.

5. Simply Travel Insurance

Simply Travel insurance is an independent Australian company based out of Brisbane. This travel insurance provides great options for travelers with the great price range. The policies of Simply travel insurance is split into different categories to serve and fit the requirement of various types of travelers. Some travelers need more coverage on medical expenses whereas there may be some who need coverage on adventure sports. So, simply travel insurance serves wide preference of customers.

Simply travel insurance also provides money back guarantee. Their policy is backed by 14 days cooling period.

What is covered?

Simply travel insurance has three simple categories of policies. They are comprehensive, budget and frequent traveler.

- Comprehensive

This category fits in for those travelers concerned with the highest level of coverage. The benefits of this policy include coverage for cancellation, luggage, medical and more.

- Budget

The budget category is ideal for the travelers who are concerned only about medical incidents like accidents and illness. The budget category provides unlimited medical coverage as well as emergency evacuation.

- Frequent Traveler

This range of policy is designed especially for the people who travel frequently, more than once a year. This policy provides unlimited coverage for journeys of up to 90 days.

4. Travel Insurance Direct

Travel insurance direct is another leading travel insurance company owned by Australian. Millions of Aussies trust it because of its service and policies. Travel insurance direct is CHOICE recommended because of their comprehensive cover policy.

The policies of Travel Insurance Direct provide timely medical help as per the need of travelers. They provide coverage for both domestic and international trips. Their policy is suitable both for business and leisure trips. They also offer flexible policies whether you are traveling single or without a partner.

Travel insurance direct provides ideal service to the people who want to explore the world and feel safe in the trip. We never know what may happen further in our journey to make a smart decision by buying travel insurance.

What is covered?

- Travel insurance direct provides coverage for 43 existing medical conditions.

- Above 100 sports activities are covered by the policy of Travel insurance direct.

- They also provide coverage for travelers going on a cruise.

- Your personal assets like phone, laptops, and cameras are also covered. Additionally, motorbikes and scooters rented on the go are also covered.

- Children traveling their parents or grandparents are also covered for free.

3. youGo

youGo is another great Aussie travel insurance which fits the needs of any categories of travelers. Whether you are planning to travel as a student, backpacker, individual, business traveler, boater, senior citizen, patient, family or a couple, youGo meets the need of all categories of travelers.

youGo offers high-quality travel insurance at a low-cost fitting with most itineraries. You can travel far and wide if you rely on this travel insurance. Whether you are traveling domestically or internationally, youGo provides worldwide cover.

youGo provides 24/7 assistance with their medical and another service team. Additionally, youGo offers medical benefits, emergency evacuation, cancellation options as well as luggage add-ons.

What is covered?

- youGo covers for your medical and dental expenses overseas. If you have to go through medical, surgical, nursing and ambulance expenses, youGo has a team of approved doctors who provide you with necessary treatment and medical evacuation.

- They also cover for the amendment and cancellation costs which may include non-refundable expenses, unused pre-paid tickets, hotels, tours, and other non-refundable expenses.

- youGo provides coverage for your luggage, travel documents and money. You can claim if any of these items get lost or stolen.

- youGo covers you in case of unexpected natural disasters like a volcano, tsunami, earthquake or other calamities. You need emergency accommodation, transport or evacuation in such cases to return back safely.

2. Travel Insurance Saver

Travel insurance saver is also another great option of insurance to choose from. It is an Australian based company which provides 24/7 worldwide medical and emergency assistance. They have a team of trained medical experts and insurance specialists who offer help anytime as per the need of situation.

Travel insurance saves to offer a range of QBE products which displays when you enter your travel details. You can choose the appropriate policy which meets all your needs and budget range. They offer ranges of policies which includes comprehensive, backpacker travel insurance, value conscious and annual multi-trip policies.

The annual travel insurance policies of Travel insurance saver is available if you are a frequent traveler or if you are traveling for 12 months. Travel insurance saver serves to meet the needs and budget of their customers.

What is covered?

- The policies of Travel insurance saver automatically cover 32 medical conditions for free.

- They cover for the emergency assistance which provides 24/7 and 365 days. They coordinate emergency assistance to the travelers holding their policy if the policyholder becomes ill or injured.

- Cruises are covered for free by Travel insurance saver.

- They also provide a range of option to choose from which covers motorcycling overseas.

- Their policy covers dependent children for free.

- Travel insurance saver also provides the option to include snow and ski cove on your policy.

- They also cover you for the rental vehicle. It covers the cost of repairing for damage caused by accident, storm, fire or theft.

1. JS travel insurance

JS travel insurance is insurance company based on UK. It provides cover for the residents of United Kingdom, the Channel Island and the Republic of Ireland. This insurance is authorized and regulated by the Financial conduct authority.

Js travel insurance is good option for the travelers seeking to travel on the high altitudes. They cover treks up to 6000 meters of altitude. Higher the altitude, more risky it is to accomplish journey safely. So get yourself a back up in the form of insurance company.

JS travel insurance provides 4 categories of policies which fit into the wide range of travelers. They are standard, essential, essential plus and superior. All these categories vary in the range of coverage they provide.

What is covered?

- Standard

This category of the policy provides coverage for the medical emergencies and personal liability of the traveler.

- Essential

This category provides more coverage than the standard one. They include a medical emergency, personal liability, cancellation and curtailment, hospital benefits, delayed departure, missed departure and legal expenses.

- Essential Plus

This category of policy covers all the elements mentioned in the essential range. Additionally, it also covers for baggage and personal money.

- Superior

This category provides the maximum amount and range of coverage. It covers for a medical emergency, personal liability, cancellation and curtailment, hospital benefits, delayed departure, missed departure, legal expenses, baggage, personal money plus the failure of the carrier.

BEST PICK

When trekking in altitude we have to make sure that our insurance company provides all the emergency services when we require it.

My personal preference when it comes to the list of the travel insurance company which covers high altitude is World Nomads. They are one of the most trustworthy insurance companies providing the best and timely services when travelers require it. They provide timely emergency services and coverage for travelers seeking to trek in high altitude region.

THE VERDICT

Trekking in high altitude region calls for numerous risks. Therefore, having your trek insured becomes mandatory to cope with the risks that may arise during your journey. And that’s one job you can leave for the travel insurance companies to handle.

They ensure your safety during the emergency and risky situations that arise in your trek. There are numerous travel insurance companies around the world providing you cover during various risky situations. But, choosing the one that covers all the possible risks you could face during a high altitude trek is a must. So, you must take your time to decide the best because a wise decision now could save you a fortune of the amount later on.